PERSONAL FINANCE

We connect you to financial tools and resources to manage your finances, reduce debt and save for the future.

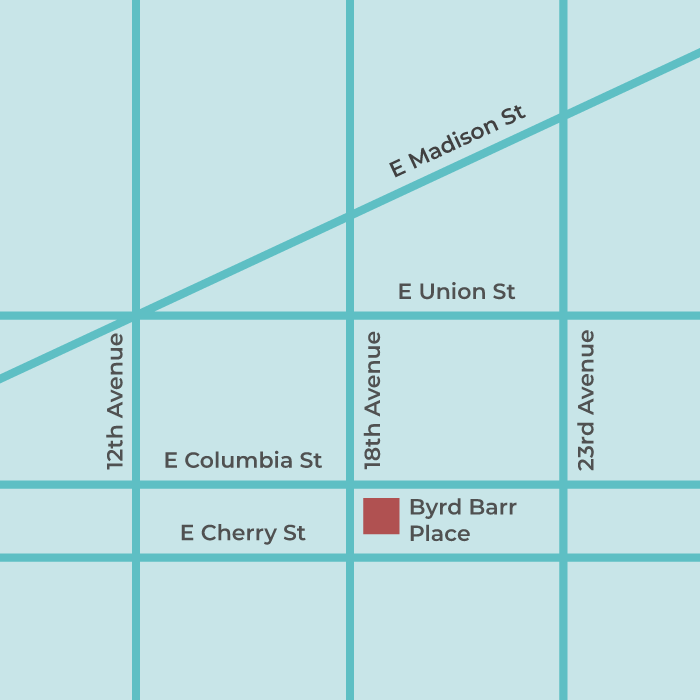

ALERT: We’re back in our firehouse home at 722 18th Ave, and are open Monday through Friday, 9 a.m. to 5 p.m.!

We recently hosted a personal finance workshop and are in the process of planning our next. We also have a number of personal finance resources below.

The Basics of Financial Health

Personal finance skills are foundational to living a healthy, happy and secure life. Explore these resources, created in partnership with College Money Habits, to learn about the fundamentals of budgeting, saving and credit — helping you manage your day-to-day finances and plan for the future.

“Most of us bury our heads, and we don’t want to deal with our credit score. It can be very scary … but I want to tell people they can take control of it.”

– Hill Harper, author of The Wealth Cure

Budgeting is creating a financial plan to spend, save and invest your money. It is the first step on the path to financial success. It starts with tracking your income and understanding your expenses, then setting financial goals and planning how to spend your money within your means.

What Is Discretionary Income?

Budgeting starts with knowing your discretionary income. Learn what goes into calculating it and apps to help you track spending against your budget.

How to Create a Personal Budget

Take charge of your financial health by following these six steps to create your own budget based on your discretionary income and spending.

The 50-30-20 Budget

This popular budgeting strategy helps you manage your money with 50% for needs, 30% for wants, and 20% for saving, investing and/or paying off debt.

Saving gives you the freedom to live the life you want. It begins with setting financial goals and creating a plan to put a little away at a time. It also involves establishing an emergency savings fund to help you navigate unexpected expenses. With discipline and sacrifice, you can build your savings to realize your goals.

Setting Financial Goals

Understanding your values and your financial goals create a framework for financial health — helping you prioritize how you spend your money and stay accountable.

Four Ways to Boost Your Savings

Savings provide financial security and enable you to pursue your passions. Start on the path to financial freedom by adopting these four strategies to amass savings.

What Is An Emergency Fund?

An essential part of financial health is creating an emergency savings fund to tap for unanticipated expenses, like medical bills or job loss. Learn how to save for emergencies.

Five Behaviors to Improve Your Credit Score

A basic building block to financial health is having a strong credit score. Learn important practices to boost your credit score.

How Is Credit Score Calculated?

Your credit score is the key to accessing credit. Understand the five factors that go into calculating your credit score so you can take control of it.

Blog | My Biggest Credit Mistake

College Money Habits Founder Obioha Okereke shares how he learned about credit utilization the hard way and what he’s done to increase his credit score.

Personal Finance Workshops

View recordings from past virtual sessions with College Money Habits founder Obioha Okereke. We explore strategies and tips for improving money management and hear from other financial experts!