By Obioha Okereke, College Money Habits

If you’re wanting to start budgeting or improve your existing budget, you’ll need to understand your discretionary income.

Understanding Discretionary Income Vs. Disposable Income

Your discretionary income is the amount of money you have after taxes and after paying for necessities, such as groceries, housing, utilities, clothing and transportation.

Necessities do not include subscription services, like Netflix, Hulu, iTunes, Spotify, or other spending related to leisure, like concert tickets, a gym membership or sports.

Discretionary income is different from disposable income, which is your earnings minus taxes.

How to Calculate Discretionary Income

First, you’ll want to figure out your total monthly disposable income. This means adding together money you’ve earned from your job, tips, commission, freelancing, benefits and any other income less taxes.

Second, add together all your necessary expenses. Be sure not to include any flexible expenses and instead focus on your regular living expenses, including groceries, mortgage or rent, utilities, healthcare and transportation.

Once you have calculated the total cost of your monthly living expenses, subtract that amount from your monthly disposable income to find your monthly discretionary income.

[Monthly disposable income ] – [Monthly essential expenses] = Discretionary income

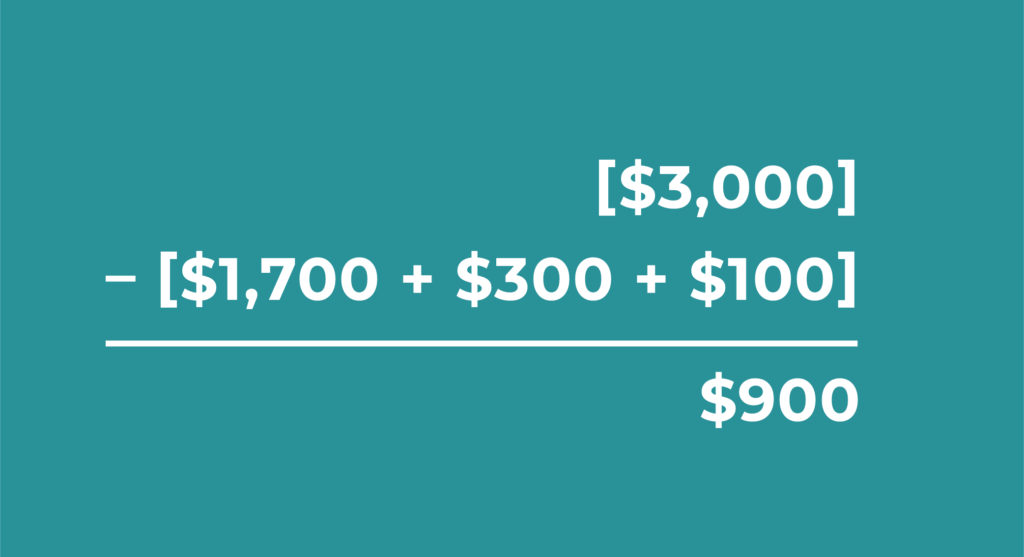

Let’s break it down with an example:

A person has a monthly after-tax income of $3,000. Their monthly expenses include $1,500 for rent, $300 for groceries and $100 for utilities, which totals $2,100.

By subtracting total expenses from your disposable income, the monthly discretionary income would be $900.

The Importance of Knowing Your Discretionary Income

Understanding your discretionary income gives you a better understanding of your financial health. More importantly, your discretionary income is the basis for building a budget.

Once you know your discretionary income, you can begin to create a budget and plan on how you save, spend and invest your income. Based on your discretionary income, you can also make decisions regarding how much you would like to allocate toward debt repayment.

If you find that your discretionary income is minimal, or that you do not have any at all, it means that you will need to either increase your income or look for ways to decrease your expenses.

One way to help you track your spending is through a budgeting app or budget tracker. Applications like Mint, You Need a Budget and Honeydue help you keep track of your expenses and allow you to link accounts so that you may monitor the balances of your loans, savings and investments.

Using Discretionary Income to Plan for Fun

While certain financial goals and circumstances might require you to cut back on spending, this does not mean you need to completely give up the things you enjoy.

Having insight into your discretionary income paints a clear picture of how much money you have to spend and where your money can go — like toward your hobbies — whether traveling, skiing, boxing or dining at new restaurants! Budgeting for fun lets you enjoy the moments you look forward to without asking yourself if you can afford it.

To learn more about planning for things you enjoy, with the people you love, check out “Planning Your Next Vacation? Create a Budget First” and “Create a Vacation Budget That You Won’t Blow”

If you have any questions regarding these personal finance resources and/or general questions about managing your personal finances, contact Obioha Okereke from College Money Habits at learn@collegemoneyhabits.com

Related Articles:

How to Create a Personal Budget

Take charge of your financial health by following these six steps to create your own budget based on your discretionary income and spending.

The 50-30-20 Budget

This popular budgeting strategy helps you manage your money with 50% for needs, 30% for wants, and 20% for saving, investing and/or paying off debt.

5 Budgeting Mistakes to Avoid

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Blog | 3 Money Lessons that helped me save $100,000

College Money Habits Founder Obioha Okereke describes three important money habits that gave him the confidence and skills to save $100,000.