The staggering proportion of wealth inequality in America still stuns even those of us engaged on the front lines, those of us who are supposedly “experts” on poverty in our region, if not our entire country. But the reality facing our clients, and us as a nation, is far grimmer than what we think it is. The “top 1%” that we keep hearing about in the news is well off, we know that, but how well off are they really?

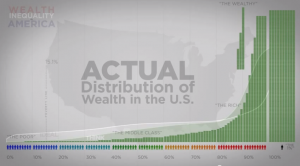

According to Harvard Business Professor Michael Norton, the top 1% of Americans control 40% of the nation’s wealth. When we look at how the bottom 50% of Americans (that is 155.5 million people, or half of the U.S. population) control 0.5% of the country’s stocks, bonds, and mutual funds, while the top 1% own 50% of the country’s investments, we must face that we have a real problem.

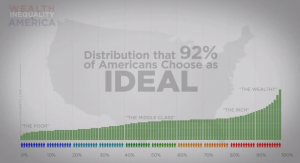

But very few Americans comprehend this is the reality. Over 92% of 5,000 people surveyed, both Republican and Democrat, both wealthy and poor, think that wealth should be “more evenly” distributed in America, not realizing that even their perception of how wealth is currently distributed would be a vast improvement over the reality.

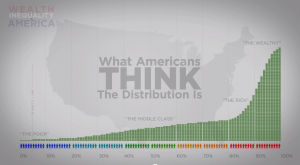

Here is what 5,000 Americans “think” wealth distribution looks like in America:

Here is what 92% of Americans think wealth distribution “should” be in America:

Here is what wealth distribution actually looks like in America:

When the bottom 80% of the population controls only 7% of the nation’s wealth, when the average worker needs to work more than a month to make what a CEO makes in one hour, it is no wonder that 1/2 of American children have to rely on food assistance at some point during their childhoods, that record numbers of people are receiving food stamps, that in Seattle alone 24,000 eligible households registered for subsidized housing vouchers in a mere three weeks. We are in a real crisis. We can’t go on like this.

What are you doing?

Learn. Reflect. Act.

To learn more-

Watch: “Wealth Inequality in America” and “A Place at the Table”