Photo by Tierra Mallorca on Unsplash

“A house is made of bricks and beams. A home is made of hopes and dreams.”

– Unknown

In the United States, homeownership has been touted as one of the best ways to build generational wealth. Beyond the financial benefits, homeownership has social and emotional benefits, allowing people to feel safe, have privacy and be rooted in their community.

For Black folks, the ability to have dominion over their space is invaluable’ it is a firm rebuttal to generations of displacements and property theft. However, systemic barriers have deliberately prevented Black people, and particularly Black women, from the benefits of homeownership. Redlining and higher-interest mortgages combined with disparities in home appraisal values and lending have far reaching consequences. According to the Black Well-Being Report produced by Black Future Co-op Fund in partnership with Byrd Barr Place, in Washington State, the homeownership rate for Black communities is only 34%, significantly lagging behind the state average of 63%. Black women face further and specific hurdles, often getting the highest interest rates across all racial categories and, preceding the 2008 foreclosure crisis, Black women were 256% more likely to receive a subprime mortgage than a white man with the same credit score and financial outlook. These numbers result in huge disparities in the average net worth of these communities and are markers of gentrification and community displacement.

The City of Tacoma reports that since 2007, there has been a loss of more than 50% of Black homeowners in its central neighborhoods. This displacement of Black families and businesses not only breaks family connections but also ends legacy businesses, erodes cultural identity, and threatens economic livelihood and the opportunity of building intergenerational wealth. A consequence of the inability to pass down intergenerational wealth is evident in the fact that 42% of Black households in Washington state have a net worth of $0. This is unacceptable.

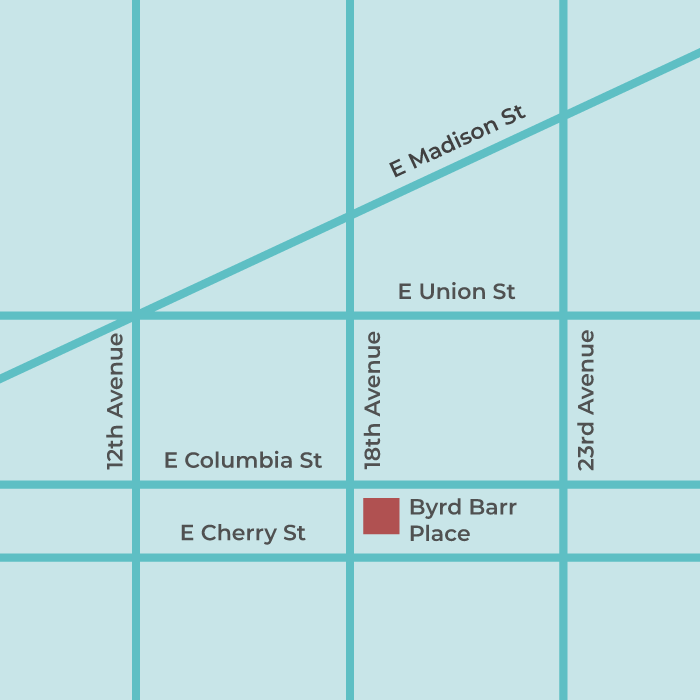

As a partner with the Black Homeownership Initiative, Byrd Barr Place is committed to increasing homeownership and household wealth among Black families by strengthening the local community investment ecosystem. We aim to add 1,500 new Black homeowners in South Seattle, South King County and North Pierce County. In addition, we strive to clearly define systemic barriers and make progress to transform them.

Addressing the disparities in Black homeownership requires a multi-level approach, tackling both individual access to the resources needed to obtain a home, while also addressing the larger systems that work to alienate Black communities. The initiative is a collaborative of organizations dedicated to Black homeownership, each with their own particular focus. An example of individual approaches include programs like HomeSight, which offers down payment assistance for first time homebuyers ranging from $10,000 to $45,000. Byrd Barr Place also recently facilitated a panel conversation about considerations and resources available for homeownership.

On a larger systemic level, addressing these disparities can look like advocating for federal oversight of our property valuation systems; ensuring that Black homeowners are not penalized during housing appraisals; deep regulation of the real estate and banking industries to root out racism and sexism; and massive investment from local and federal governments to build affordable housing.

Ensuring an equitable Black future means addressing all barriers to the health, wealth and well-being of Black communities. Black homeownership is a central facet of this effort by deepening community roots, disrupting systems of marginalization and manifesting generational wealth.